False Breakout Pattern

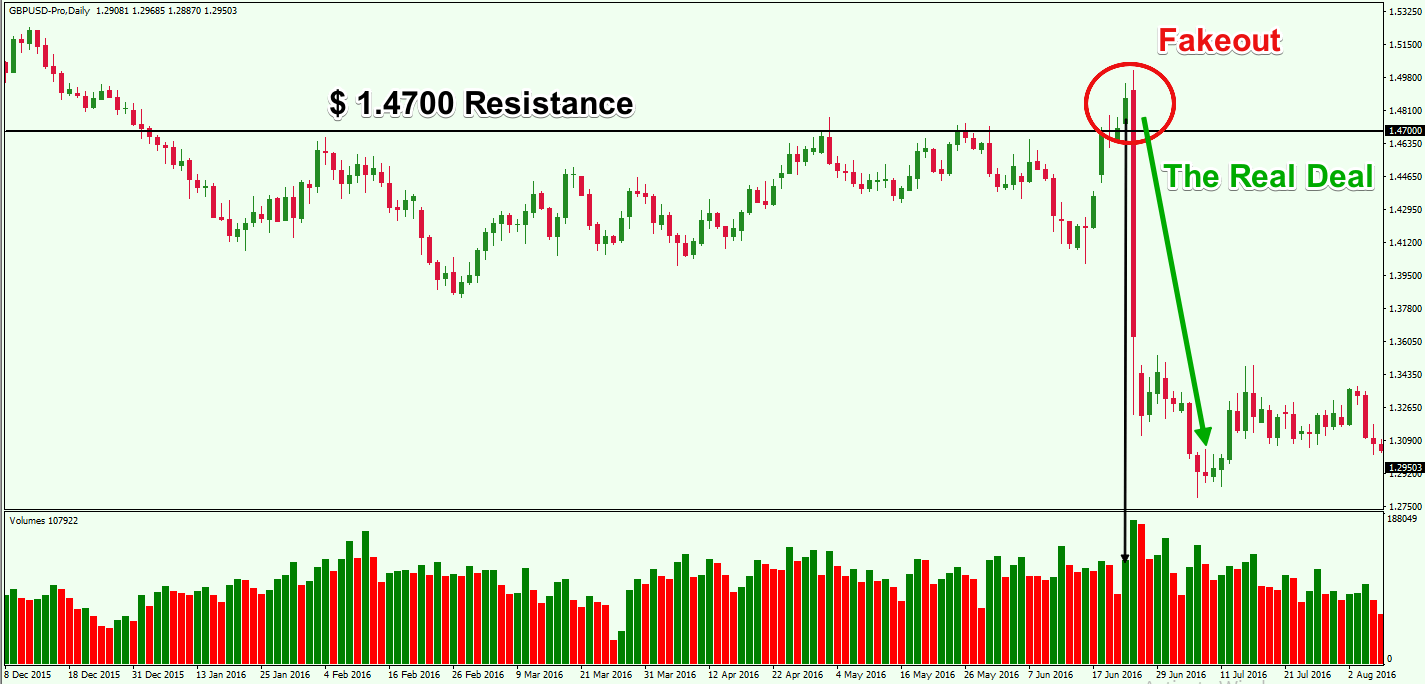

False Breakout Pattern - Web typically, false breakout candle patterns indicate that the initial breakout from the support or resistance level lacks the momentum to continue the trend. Web to determine the difference between a breakout and a fakeout, wait for confirmation. Boundary of the chart pattern formation; That's a trade you want to be long (buy) because the trend dictates the price is likely to move higher. Most traders tend to think a level will break just because a market has approached it aggressively, they then buy or sell the breakout and. Web finding a trending market, look for pullbacks and then a break in the same direction of the high or low pivot. With us, you can trade on breakouts and failed breaks using cfds. Finding the correct pattern as rightfully mentioned by our partner fxstreet, a breakout trading strategy is one of the most popular methods for trading the forex and cfd market. False breakouts give clues about an impending market direction, hence, they should be watched keenly. For example, fakeouts occur when prices open beyond a support or resistance level, but by the end of the day. Web what are false (failed) breakouts (breakthroughs)? Most traders tend to think a level will break just because a market has approached it aggressively, they then buy or sell the breakout and. Web a false break occurs when the price moves through a certain level of support or resistance but does not have enough momentum to maintain its direction. The. Web to determine the difference between a breakout and a fakeout, wait for confirmation. That's a trade you want to be long (buy) because the trend dictates the price is likely to move higher. Web a failed break is also commonly referred to as a false breakout. key takeaways a failed break is when the price of a security moves. For instance, a true breakout necessitates closing above the resistance level. In other words, the breakout signal turns out to be a false alarm, trapping traders who entered positions based on the initial breakout. Web two common patterns where false breakouts tend to occur are: Yet learning how to trade breakouts properly is difficult. Web a false break, or breakout,. Yet learning how to trade breakouts properly is difficult. Strategy below ↓ if you want to make this strategy work, save it and adapt the simple steps be. For example, fakeouts occur when prices open beyond a support or resistance level, but by the end of the day. Look for consolidation (trading range) and look for price to take out. Web 💰 expert content: For instance, a true breakout necessitates closing above the resistance level. Yet learning how to trade breakouts properly is difficult. Web a false breakout is said to have occurred when a breakthrough a key level is rejected. Finding the correct pattern as rightfully mentioned by our partner fxstreet, a breakout trading strategy is one of the. Web technical analysts offer various clues for recognizing false breakouts of levels or trendlines. In simple words, a false breakout takes place when the price moves forward through some level but doesn’t have a sufficient impulse and moves back through the level. False breakouts give clues about an impending market direction, hence, they should be watched keenly. Web two common. In other words, the breakout signal turns out to be a false alarm, trapping traders who entered positions based on the initial breakout. Web to determine the difference between a breakout and a fakeout, wait for confirmation. A false breakout to the downside adds. Web 💰 expert content: Web for those who don't know, a false breakout is a rather. Strategy below ↓ if you want to make this strategy work, save it and adapt the simple steps be. When the initial breakout happens, many traders are lured into the trade by entering the market in the direction of the breakout. You can look for a trading indicator such as a. Web false breakouts are occurrences on the chart when. Yet learning how to trade breakouts properly is difficult. Finding the correct pattern as rightfully mentioned by our partner fxstreet, a breakout trading strategy is one of the most popular methods for trading the forex and cfd market. Most traders tend to think a level will break just because a market has approached it aggressively, they then buy or sell. False breakouts give clues about an impending market direction, hence, they should be watched keenly. Boundary of the chart pattern formation; Web what are false (failed) breakouts (breakthroughs)? Web false breakouts are occurrences on the chart when the price breaks an obvious level, but then suddenly changes direction. Look for consolidation (trading range) and look for price to take out. In simple words, a false breakout takes place when the price moves forward through some level but doesn’t have a sufficient impulse and moves back through the level. Web finding a trending market, look for pullbacks and then a break in the same direction of the high or low pivot. Web for those who don't know, a false breakout is a rather common condition in trading where price penetrates known support or resistance on the chart, but ultimately lacks the momentum needed to sustain the move. In other words, the breakout signal turns out to be a false alarm, trapping traders who entered positions based on the initial breakout. Web the most common entries for a fakey signal include the following: Web 💰 expert content: Web a false break occurs when the price moves through a certain level of support or resistance but does not have enough momentum to maintain its direction. Web technical analysts offer various clues for recognizing false breakouts of levels or trendlines. Horizontal support or resistance level; However, with time and experience, this pattern can become an instrumental part of your trading arsenal. That's a trade you want to be long (buy) because the trend dictates the price is likely to move higher. The price breaks slightly below the triangle, only to quickly jump back in. Web a failed break is also commonly referred to as a false breakout. key takeaways a failed break is when the price of a security moves beyond a support or resistance level (breakout) but. Yet learning how to trade breakouts properly is difficult. This chart is just for information. For example, fakeouts occur when prices open beyond a support or resistance level, but by the end of the day.

Stock Market Chart Analysis Trade the false breakout

False Breakout Pattern

False Breakouts and Fakeouts Can Be Profitable Setups Forex Training

False Breakout Strategy The best trading approach Pro Trading School

![]()

Whipsaw Forex Trading Fakeout & False Breakout Pattern ForexBoat

False Breakout Pattern Forex Training Group

False Breakout Strategy A Simple Yet Powerful Approach

False Breakout Pattern

Stock Market Chart Analysis GOLD False breakout

How to Recognize False Breakouts YouTube

If Closing Prices Fall Below The Resistance Level, The Breakout May Be False, And The Rise Here Is Unlikely.

For Example, The Trend Is Up And A Triangle Pattern Develops.

Web A Failed Breakout Tells You The Price Is Not Yet Ready To Move Beyond The Support Or Resistance Level.

Look For Consolidation (Trading Range) And Look For Price To Take Out The High Or Low.

Related Post: